The Complete Guide to San Diego Moving Insurance

Summary:

Moving can be daunting, and ensuring your belongings’ safety is paramount. This guide dives deep into moving insurance in San Diego, shedding light on its importance, types, costs, and how to choose which insurance companies offer the best coverage. Drawing from Qshark Moving Company’s vast experience, we provide insights to help you make informed decisions for a stress-free move.

| Protection Type | Pros | Cons |

|---|---|---|

| Released Value Protection | – No additional cost – Basic coverage for all items | – Limited compensation based on weight – Might not cover the actual value of items |

| Full Value Protection | – Comprehensive coverage – Compensation based on actual value or replacement | – Additional cost – Might have deductibles |

| Third-Party Insurance | – Can provide coverage beyond mover’s liability – Flexible plans and coverage options | – Additional cost – Might overlap with existing coverage |

I. Introduction

Moving to a new home or office in San Diego is an exciting journey. But with the thrill of a fresh start comes the responsibility of ensuring the safety of your personal and valuable items. At Qshark Moving Company, we’ve witnessed firsthand the challenges that can arise during a move. From natural disasters to accidental damages, the risks are real. That’s where a reputable moving company with insurance steps in as a safety net.

Why Consider Moving Insurance?

Protects your belongings against unforeseen damages or losses.

Provides peace of mind during the moving process.

Ensures you get value for lost or damaged goods rather than bearing the full brunt of replacement costs.

Qshark’s Experience:

As professional movers in San Diego, we’ve seen a range of scenarios. While our team strives for perfection, external factors can sometimes play a role. Whether it’s the unpredictable San Diego weather or the hustle and bustle of city traffic, moving insurance is a cushion against these unpredictable elements.Cost Considerations:

The cost of moving insurance can vary. As highlighted in our previous blog, several factors influence the final price. But one thing remains constant: its peace of mind is priceless.

In this guide, we’ll delve deeper into the intricacies of moving insurance, helping you understand its types, benefits, and how to choose the right moving coverage amount for your needs. Whether you’re looking for basic coverage or full-value protection, we’ve got you covered.

II. What is Moving Insurance?

At its core, moving insurance is designed to provide coverage and to protect your belongings during the transition from one place to another. But it’s not as simple as it sounds. There are various types of coverages, each with its own set of rules and benefits.

A. Definition and Basic Understanding

Moving Insurance vs. Valuation Coverage:

Many people mistakenly believe that moving insurance and valuation coverage are the same. In reality, federal law requires all moving companies to offer valuation coverage, but this is not insurance. It’s a level of liability the mover accepts.

B. The Importance of Differentiating

Valuation Coverage:

This is the most basic coverage and is often included in your moving fee. It provides limited protection based on weight, often around 60 cents per pound per item. So, if a 50-pound television gets damaged, you’d receive $30, regardless of the TV’s actual value.Moving Insurance:

This is a separate policy you purchase from either the moving company or a third-party insurance company. It offers more comprehensive protection, covering the actual value, replacement value, or a predetermined amount for lost or damaged goods.

| Criteria | Released Value Protection | Full Value Protection |

|---|---|---|

| Cost | Usually free | Additional charge |

| Coverage Basis | Based on weight (typically 60 cents per pound per item) | Based on the full replacement value of items |

| Compensation | Limited to the weight of the item, regardless of its actual value | Repair, replace, or cash settlement based on the item’s current market value |

| Best For | Low-value items or short moves | High-value items or long-distance moves |

III. Why is Moving Insurance Essential for San Diego Residents?

With its beautiful coastline and bustling urban areas, San Diego presents unique challenges for movers. Here’s why moving insurance is particularly crucial in this region:

A. Natural Disasters

San Diego is prone to certain natural disasters like wildfires and occasional earthquakes. While Qshark Moving Company ensures the utmost care, some things are beyond a mover or rental company’s control.

Protection Against Unpredictables:

Moving insurance can cover damages from unforeseen events, ensuring you don’t bear the financial burden of such mishaps.

B. Urban Moving Challenges

Traffic and Accidents:

The bustling streets of San Diego can sometimes lead to transit accidents. Insurance ensures your belongings are covered in such events.Narrow Streets and Alleyways:

Some areas in San Diego have narrow passages, making the moving process tricky. The risk of damage increases in such scenarios, making insurance all the more essential.

C. High-Value Items

San Diego residents often possess high-value items, from electronics to antiques.

Full Value Protection:

For items of extraordinary value, basic coverage might not suffice. Full value protection ensures that you receive the item’s current market value or a replacement in the event of damage.

IV. Types of Moving Insurance

Understanding the different types of moving insurance is crucial to making an informed decision to purchase moving insurance. Here’s a breakdown:

A. Basic Carrier Liability

Offered by all moving companies as per law.

Provides limited coverage, often at 60 cents per pound.

It’s the bare minimum coverage and might not be sufficient for high-value items.

B. Full Value Protection

Covers the actual value of an item.

In case of damage, the insurance company can offer a cash settlement, repair the item, or provide a replacement.

Typically comes at a higher cost but offers comprehensive protection.

C. Declared Value Protection

Based on the total weight of your shipment.

You declare a specific amount per pound, determining the insurance coverage.

It’s a balance between basic coverage and full value protection.

V. Factors Influencing the Cost of Moving Insurance in San Diego

When considering moving insurance, understanding the cost protection moving insurance is crucial. Several factors can influence the final price of your moving insurance in San Diego.

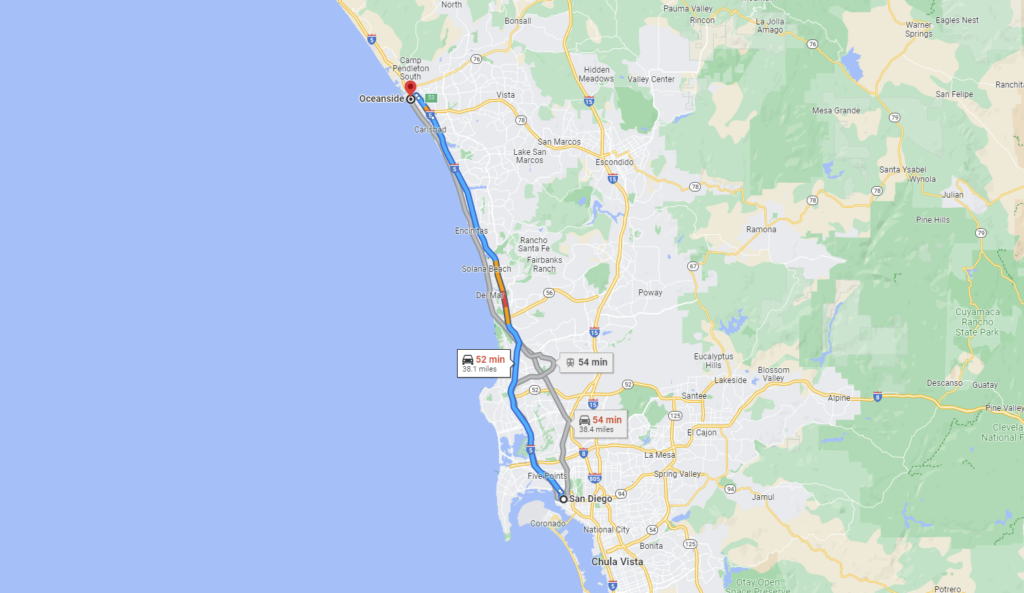

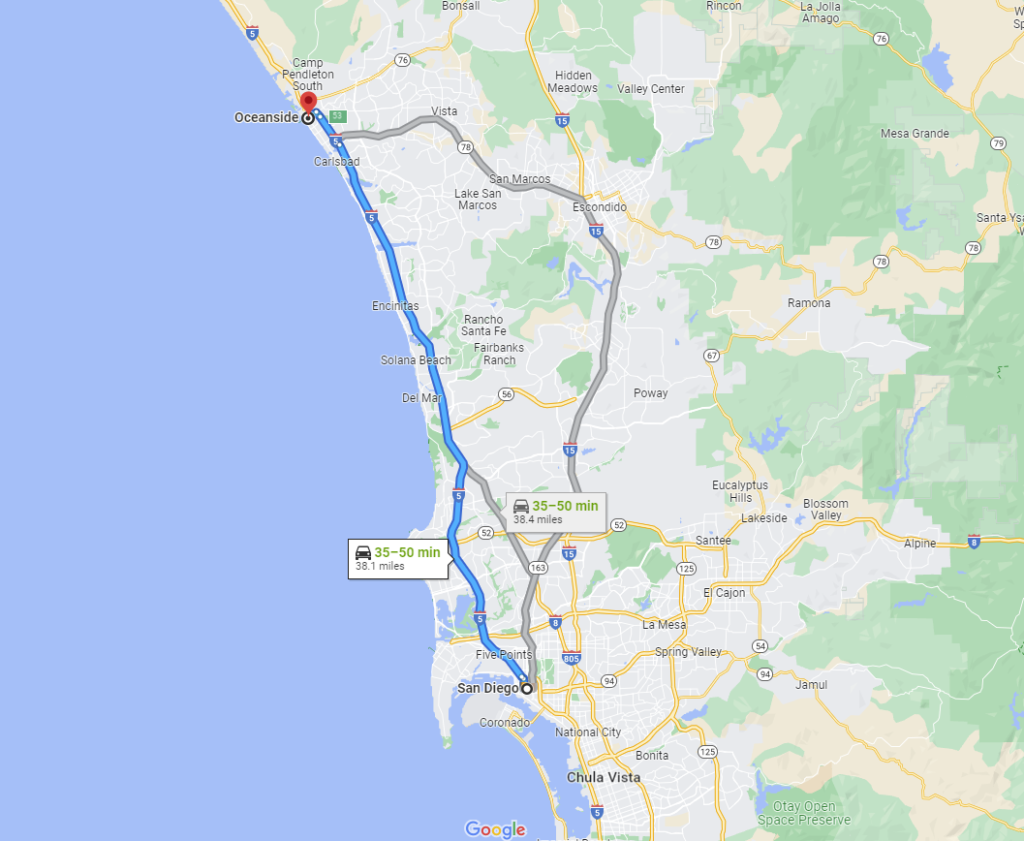

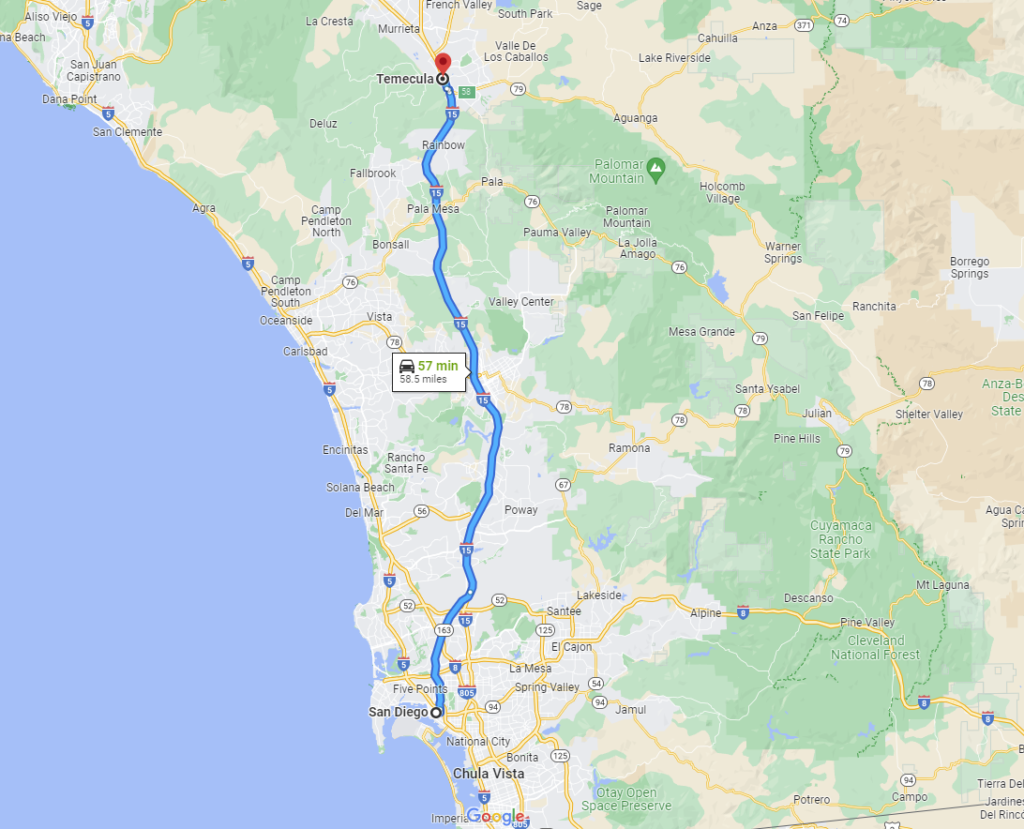

A. Distance of the Move

Local Moves:

The risk is generally lower for moves within San Diego or short distances, leading to reduced insurance costs.Out-of-State Moves:

Longer distances mean more time on the road and increased risks. This can lead to higher insurance premiums.

B. Total Weight of Items

The more you move, the higher the potential moving insurance cost. This is especially true for declared value protection, where the coverage is based on the total weight of your shipment.

C. Declared Value of Belongings

If you declare a higher value for your belongings (especially for high-value items), expect to pay a higher premium. It’s essential to accurately assess the value of your belongings to ensure adequate coverage.

D. Specific Risks Associated with San Diego

As mentioned, San Diego has unique challenges like natural disasters and urban moving challenges. These can influence the cost of insurance.

E. Chosen Insurance Type

Basic Carrier Liability:

Often included in the moving fee and offers limited coverage at a lower cost.Full Value Protection:

Comprehensive coverage comes at a higher price.Declared Value and Other Types:

Costs vary based on the specifics of the policy and the declared values.

F. Additional Factors from Qshark’s Experience

Drawing from our extensive experience as San Diego movers, other factors can influence insurance costs:

Seasonality:

Moving during peak seasons might slightly increase insurance premiums due to higher demand.Special Handling:

Items that require special handling or packaging can influence insurance costs.Deductibles:

Some policies might offer lower premiums if you agree to a higher deductible.

VI. How to Choose the Right Moving Insurance for Your Needs

With various options available, making the right choice can be overwhelming. Here’s a step-by-step guide to help:

A. Assess the Value of Your Belongings

Create an inventory list and note down the estimated value of each item.

Consider getting an appraisal for high-value items to determine their current market value.

B. Understand the Specific Risks of Your Move

Are you moving locally within San Diego or out of state?

Do you possess items that require special handling?

C. Consult with Professionals

At Qshark Moving Company, we recommend discussing your move with our team. We can provide:

Insights on the best insurance options based on our experience.

Recommendations on third-party insurance companies if needed.

Tips on saving money without compromising on coverage.

D. Read the Fine Print

Ensure you understand the terms and conditions of your chosen policy.

Look for any coverage gaps or exclusions that might affect your belongings.

VII. Claiming Insurance: Steps and Tips

Even with the best precautions, damages can occur. Knowing how to navigate the claims process to ensure you receive the compensation you deserve.

A. The Process of Filing a Claim

Immediate Inspection:

Inspect your belongings for any visible damages or missing items when they are delivered.Document Everything:

Take clear photographs of any damages. This will serve as evidence when filing your claim.Contact Your Moving Company:

Contact Qshark Moving Company or your respective movers immediately to report the damage.Submit a Written Claim:

Most insurance companies require a formal written claim. Ensure you provide all necessary details and attach supporting documents.Await Assessment:

The insurance company might send an assessor to evaluate the damage. Be cooperative and provide any additional information they might need.Settlement:

Once your claim is approved, the company will offer a settlement based on your policy’s terms.

B. Tips for a Smooth Claim Process

Act Quickly:

Most insurance policies have a time limit for filing claims. Ensure you act promptly.Keep All Documentation:

Keep all documents safe from your initial moving agreement to the inventory list and damage photos.Be Detailed:

The more detailed your claim, the better. Specify the nature of the damage, the item’s value, and any other relevant information.Stay Calm and Patient:

The claims process can sometimes be lengthy. Stay patient and cooperate fully with the company.

How To File A Claim

| Step | Action |

|---|---|

| 1. Immediate Inspection | Inspect your belongings as soon as they are delivered for any visible damages or missing items. |

| 2. Document Everything | Take clear photographs of any damages as evidence for your claim. |

| 3. Contact Your Moving Company | Reach out to your moving company immediately to report the damage. |

| 4. Submit a Written Claim | Provide a formal written claim with all necessary details and supporting documents. |

| 5. Await Assessment | The insurance company may send an assessor to evaluate the damage. Cooperate and provide any additional information they might need. |

| 6. Settlement | Once your claim is approved, the insurance company will offer a settlement based on your policy’s terms. |

VIII. Common Myths and Misconceptions about Moving Insurance

Misinformation can lead to wrong decisions. Let’s debunk some common myths:

A. “All Damages are Covered”

Not all policies cover every type of damage. For instance, damages due to natural disasters might not be covered under basic coverage.

B. “Moving Companies Automatically Provide Full Coverage”

Federal law mandates that moving companies like Qshark Moving Company offer basic valuation coverage. However, full value protection or other insurance types are separate and might incur additional costs.

C. “Renters Insurance Covers Moving Damages”

While some renters policies might offer coverage for damages during a move, but it’s not guaranteed. Always check with your insurance provider.

D. “I Don’t Need Insurance for Local Moves”

Even if you’re moving within San Diego, damages can occur. Local moves can also benefit from moving insurance.

IX. Qshark Moving Company’s Approach to Moving Insurance

At Qshark Moving Company, we prioritize our client’s peace of mind.

A. Ensuring Safety

Our team is trained to handle items with the utmost care, minimizing the risk of damage.

B. Guidance on Insurance Options

We provide insights on the best insurance options, helping clients make informed decisions.

C. Partnerships with Insurance Providers

While we offer basic valuation coverage, we can also recommend trusted third-party insurance providers for comprehensive protection.

D. Transparent Communication

We believe in clear communication, ensuring our clients understand the coverage levels and any associated costs.

X. Things to Consider.

Moving is more than just a physical transition; it’s an emotional journey filled with hopes, dreams, and, sometimes, anxieties. Ensuring the safety of your cherished belongings is a critical aspect of this journey. With the right moving insurance, you can mitigate risks and ensure you’re well-covered even if the unexpected happens.

At Qshark Moving Company, we’ve been a part of countless moving stories. Our experience has taught us the value of preparation, care, and the importance of having a safety net. Moving insurance is that safety net.

Whether you’re moving within the vibrant neighborhoods of San Diego or venturing out of state, understanding and investing in the right moving insurance can make all the difference. It’s not just about protecting your belongings; it’s about ensuring peace of mind as you step into a new chapter of your life.

XI. Frequently Asked Questions (FAQs)

To further assist our readers, here are answers to some commonly asked questions about moving insurance:

Do all moving companies offer moving insurance?

By law, all moving companies provide basic valuation coverage. However, comprehensive moving insurance is typically offered as an additional service or through third-party insurers.How much does moving insurance cost in San Diego?

The cost varies based on several factors, including the type of coverage, the value of items, and the distance of the move. For detailed pricing insights, refer to our blog post.Is moving insurance worth it for short-distance moves?

Absolutely. Even during short moves, damages can occur. It’s always better to be prepared.Can I rely on my homeowners or renters’ insurance during a move?

Some homeowners’ or renters policies might cover damages during a move, but it’s essential to check with your insurance provider for specifics.What if my high-value item gets damaged?

If you’ve opted for full value protection or declared value protection, you should receive compensation based on the item’s current market value or the declared value. Always ensure high-value items are adequately covered.

XII. Delving Deeper: Understanding Moving Insurance Terms and Options

A. Released Value Protection vs. Full Value Protection

Released Value Protection:

Often referred to as “released value coverage,” this is the most basic liability option available. Moving companies offer it at no additional charge, but its protection is minimal. Under the law, moving companies are obligated to provide this coverage. It offers compensation based on weight, typically at 60 cents per pound per item.Full Value Protection:

This is a more comprehensive plan. If any of your items are lost, damaged, or destroyed during the move, the moving company has three options: repair the item, replace it with a similar item, or offer a cash settlement for the full replacement value. The “full value protection level” indicates the total liability a moving company is responsible for loss or damage to your items.

B. Third-Party Moving Insurance

While your moving company provides basic coverage options, sometimes you might need more comprehensive protection. This is where your third party insurer third-party insurers come in.

Trip Transit Insurance:

This covers personal property for theft, disappearance, or fire while in transit or storage.Relocation Insurance:

Offered by groups like the “relocation insurance group,” this provides comprehensive coverage options for your move.Third-Party Moving Insurance:

Some moving companies might not offer full coverage insurance. In such cases, you can purchase additional coverage from a third-party company to cover the insurance gap.

C. Understanding Liability and Coverage

Mover’s Liability:

Every moving company must provide free basic liability coverage. However, this might not cover the full value of your belongings.Separate Liability Coverage:

This is the amount of insurance you buy, minus the moving company’s liability (usually the released value protection). If you purchase this from your moving company, they’re responsible for the amount of insurance purchased and their liability.Supplemental Liability Coverage:

Some truck and rental companies offer this additional coverage when renting a vehicle for moving.

D. Homeowners and Renters Insurance in the Moving Process

Homeowners Insurance Policies:

Some homeowners insurance policies might cover damages during a move, but you must check with your provider. Often, there’s a “homeowners policy cover” for moving, but it might have limitations.Renters Insurance Policy:

If you have a renters insurance policy, it might cover damages during the move. However, it’s crucial to understand the specifics. For instance, does your “renters insurance cover moving” explicitly, or are there exceptions?

E. Additional Considerations

State Insurance Laws:

Different states have different regulations. Understanding state insurance laws is essential, especially if you’re moving interstate.Coverage Options:

From “full coverage” to “valuation estimate,” it’s crucial to understand the various coverage options available and choose the one that best fits your needs.Natural Disasters and Other Hazards:

Some policies might not cover damages from “natural disasters, mechanical” failures, or “electrical accidents mold.” Ensure you’re aware of any exclusions.Saving Money:

While ensuring your belongings are essential, you don’t want to overpay. Consult with professionals, compare quotes, and see where to “save money” without compromising protection.

XIII. Conclusion: Making an Informed Choice

Choosing the right insurance is about understanding your needs, the value of your personal belongings, and the risks involved. Whether opting for a “full value protection level” or understanding the nuances of “third party moving insurance,” being informed is key.

At Qshark Moving Company, we’re committed to ensuring our clients have all the information they need. From providing an “insurance certificate” to guiding you on “additional coverage” options, we’re here every step of the way.

Remember, while moving is a significant step, ensuring the safety of your personal property is paramount. Make an informed choice, and embark on your new journey with confidence.